FOR IMMEDIATE RELEASE Sustainable Energy Fund Contact: Katrina LaubachMarketing [email protected] Family Promise Contact: Cathy LammExecutive [email protected] Sustainable...

» Read MoreSummer Series: Pricing & Carbon

The last entry in the RFO Summer Series highlights the pricing of RFO in the market of Pennsylvania.

What are the energy prices in Pennsylvania?

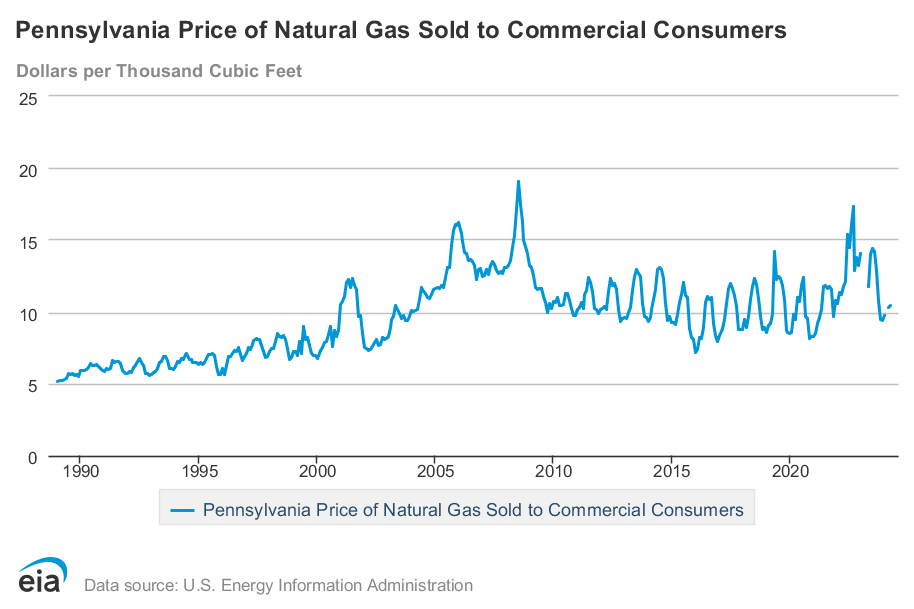

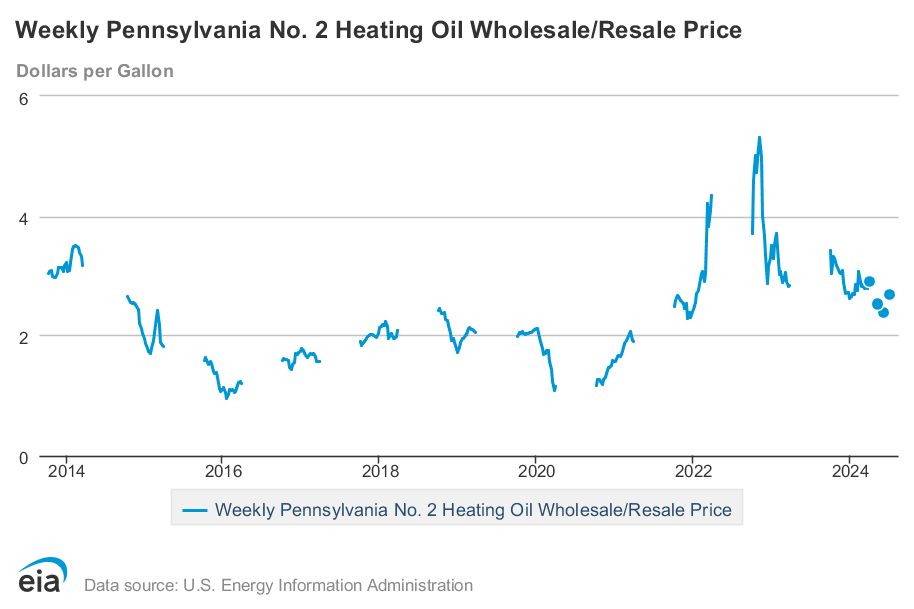

The Energy Information Administration (EIA) reports on energy prices at the state level.

In April 2024, natural gas costs for commercial customers averaged around $10.22/MMBtu. No. 2 heating oil in PA was $21/MMBtu in April 2024.

Compared to EIA-reported data, RFO is estimated to be a price-competitive alternative for commercial natural gas and especially for No. 2 heating oil. However, these energy prices can differ substantially between institutions depending on contract terms, facility scale, and market factors.

Please note that in these graphs, units were converted from thousand cubic feet and gallon to MMBtu.

Can RFO increase resiliency?

In recent years, energy prices in Pennsylvania have been very volatile.

For commercial customers, September 2022 saw natural gas prices at about $17/MMBtu. In November 2022, No. 2 heating oil peaked at about $38.31/MMBtu. Due to recent market volatility, institutions with contract renewals may experience substantial rate increases for natural gas in the near future.

Supply chain challenges can limit the availability of fuel for institutions, increasing fuel prices and potentially disturbing operations. Utilizing RFO in a multifuel system can provide an alternative to fossil fuels during these times, increasing resiliency to supply shortages and price volatility.

How can RFO work with carbon pricing mechanisms?

The government at all levels (federal, state, and local) and some institutions have considered and/or implemented various carbon pricing mechanisms. These mechanisms encourage low-carbon alternatives, further justifying and incentivizing actions towards decarbonization. If carbon pricing is implemented, RFO may become more price-competitive with traditional fossil fuels.

Many factors can prevent institutions from decarbonizing on their own. To meet their environmental targets, these institutions often purchase carbon offsets, in which the funds aid in clean energy or carbon sequestration projects. RFO’s potential 80% reduction in life cycle greenhouse gas emissions compared to natural gas and fuel oil operations can directly reduce an institution’s carbon emissions. This would reduce the need for carbon offsets to meet climate goals or policies.

In December 2023, the EPA estimated the social cost of carbon (the net societal harm of adding one ton of emissions in a year) to be $190/ton.

While this estimate is not used in the current market, government agencies do consider this estimate when performing cost-benefit analyses and developing environmental policies. These policies may impact the RFO market, justifying additional costs and incentivizing the utilization of RFO. Using the same methodology at the institutional level can further illustrate RFO’s benefits over traditional fossil fuels.

Call to Action

A multifuel system utilizing RFO can allow institutions to optimize fuel costs, reduce dependency on carbon offsets, increase resiliency, and meet environmental targets.

SEF is actively seeking interested parties who may serve as early adopters to bring this opportunity to Pennsylvania.

Check back regularly for more information on RFO.